Table of Contents

Introduction

If you’re a small business owner, freelancer, or startup founder, you understand how essential accurate and seamless accounting is for your operations. In the ever-evolving world of cloud software, Xero has emerged as a trusted name. With more than 3 million users worldwide, it has become one of the top choices for cloud-based accounting.

In this detailed review, we’ll walk you through everything you need to know about Xero — its features, benefits, drawbacks, pricing plans, and how it stacks up against competitors like QuickBooks, Zoho Books, and FreshBooks.

What Is Xero?

Xero is a cloud-based accounting software designed specifically for small and medium-sized businesses. Founded in New Zealand in 2006, it has quickly grown to become a global powerhouse with robust tools for:

- Invoicing

- Payroll (in select countries)

- Bank reconciliation

- Financial reporting

- Expense tracking

- Inventory management

Its user-friendly interface and third-party integrations make it ideal for business owners who aren’t accountants but still need precise control over their finances.

Why Choose Xero?

Here are some top reasons why small businesses love Xero:

Cloud-Based and Accessible Anywhere

Xero is entirely cloud-based. Whether you’re at your desk or on the go, all your financial data is accessible in real-time from any device.

Seamless Bank Feeds

Xero automatically connects with your bank and imports your transactions, helping you reconcile and stay updated without manual work.

Real-Time Collaboration

Xero allows business owners, accountants, and advisors to work together on the same data simultaneously.

Clean, Intuitive Interface

Even if you’re not tech-savvy, Xero’s clean UI ensures you can navigate easily and manage your finances with confidence.

Key Features of Xero

Let’s dive deeper into what makes Xero a complete solution for modern businesses:

1. Smart Invoicing

- Create and send professional invoices in seconds

- Add payment links (Stripe, PayPal)

- Set up recurring invoices and auto-reminders

2. Bank Reconciliation

- Auto-import transactions

- AI-powered suggestions for categorizing expenses

- Reconcile transactions in bulk

3. Inventory Tracking

- Track inventory in real-time

- Know what’s in stock and what’s selling fast

- Auto-update inventory based on invoices and sales

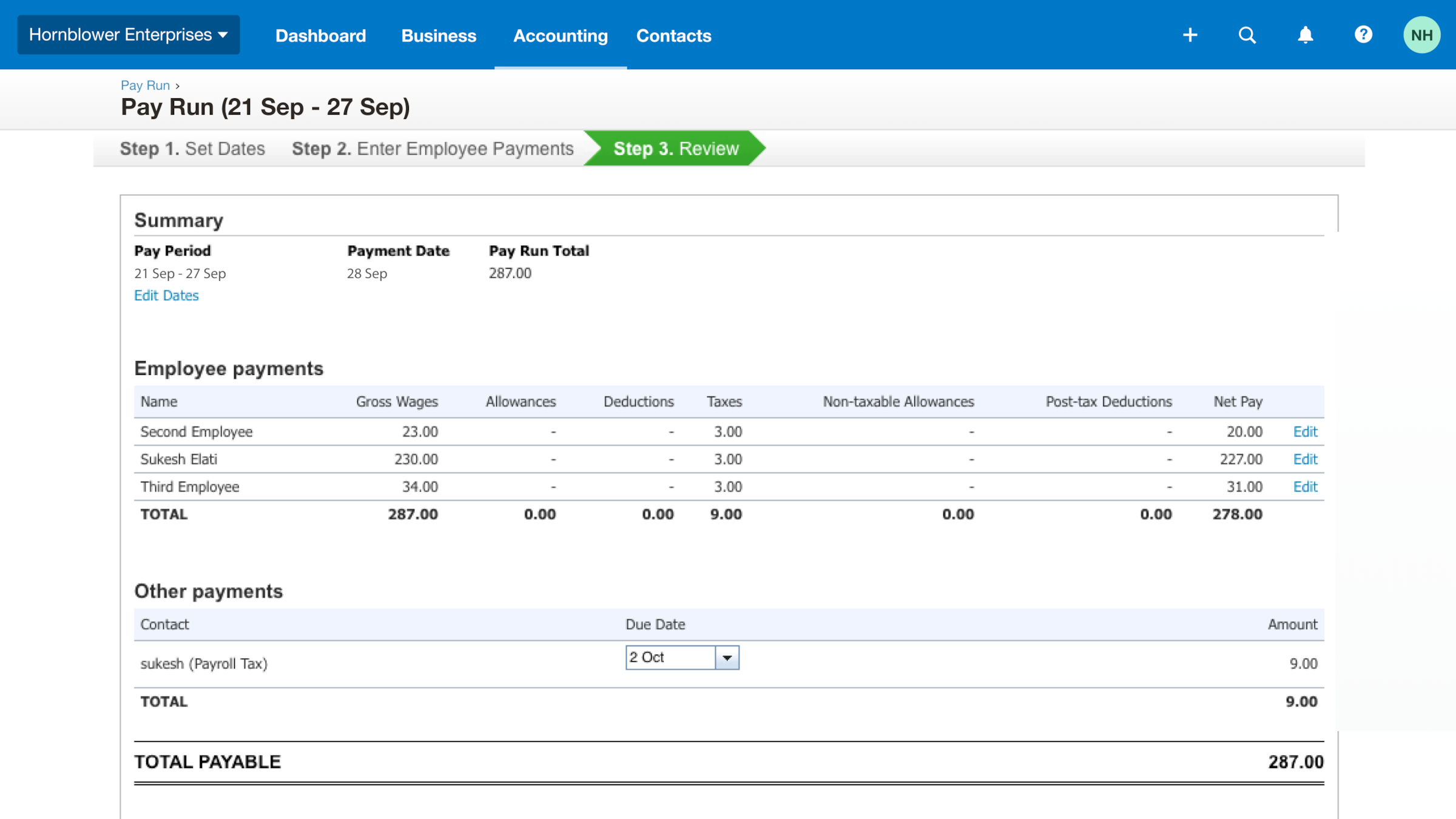

4. Payroll Management

(Available in selected countries like the UK, Australia, and New Zealand)

- Calculate pay and deductions

- Submit reports to tax authorities

- Generate payslips

5. Expense Claims

- Track and reimburse employee expenses

- Approve or reject claims in one click

- Snap receipts via mobile app

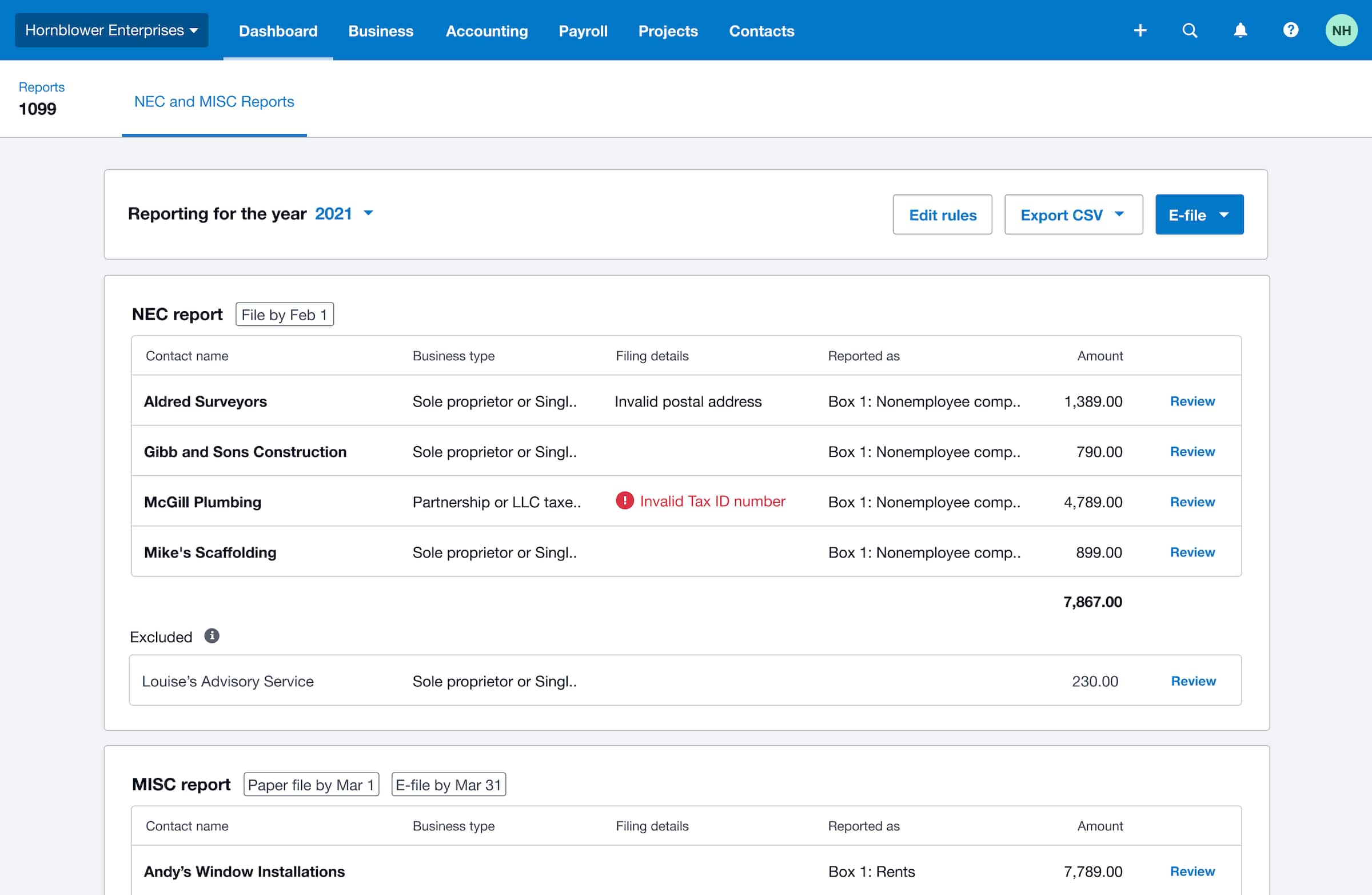

6. Financial Reporting

- Generate real-time profit and loss statements, balance sheets, and cash flow reports

- Share reports with your accountant easily

- Customize reporting templates

7. Mobile App

- Manage your business finances on the go

- Create invoices, reconcile transactions, and upload receipts

Xero Pricing Plans (2025)

| Plan | Price | Features |

|---|---|---|

| Early | $20/month | Send up to 20 invoices & enter 5 bills |

| Growing | $47/month | Unlimited invoices & bills |

| Established | $80/month | Multi-currency, expense tracking, and advanced features |

💡 Pro Tip: Start with the Growing plan if you invoice clients frequently or manage numerous expenses.

Pros and Cons of Xero

Pros

- Intuitive, user-friendly interface

- Excellent mobile app

- Strong automation features (e.g., auto-invoicing, reminders)

- 1000+ integrations (Stripe, Gusto, Shopify, HubSpot)

- Scales well with growing businesses

Cons

- Payroll is only available in limited countries

- No built-in time tracking (requires third-party app)

- Customer support is email-based only

How Does Xero Compare to Alternatives?

Here’s how Xero compares to other popular tools:

| Feature | Xero | QuickBooks Online | Zoho Books | FreshBooks |

|---|---|---|---|---|

| Bank Feeds | ✅ | ✅ | ✅ | ✅ |

| Invoicing | ✅ | ✅ | ✅ | ✅ |

| Payroll | ✅ (limited) | ✅ | ❌ | ✅ |

| Multi-Currency | ✅ | ✅ (Premium) | ✅ | ✅ |

| Mobile App | ✅ | ✅ | ✅ | ✅ |

For more details, check our comparison: Xero vs QuickBooks vs FreshBooks

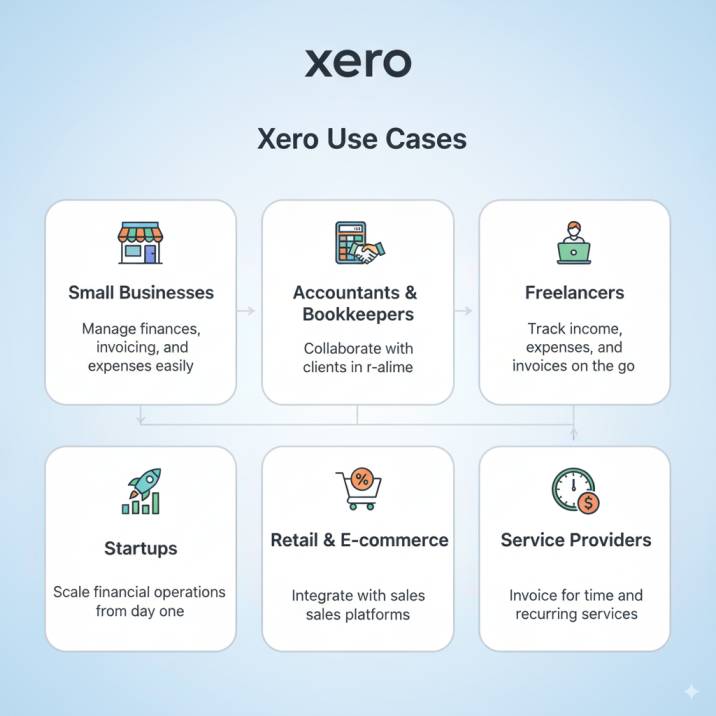

Who Should Use Xero?

Xero is best suited for:

- Freelancers & solopreneurs

- Small businesses with 1–50 employees

- Ecommerce businesses (thanks to integrations)

- Accounting firms & bookkeepers

It’s especially great for businesses needing cloud-first collaboration with accountants or teams.

Xero Use Cases

Ecommerce Store Owner

Integrate Xero with Shopify or WooCommerce and sync your sales, taxes, and inventory in real-time.

Freelancer

Create and automate invoices, accept payments online, and track your income and expenses from anywhere. Accounting Firm

Handle multiple client accounts with a centralized dashboard. Invite clients and collaborate on financial reports easily.

How to Get Started with Xero

- Sign Up for a Free Trial – Xero offers a 30-day free trial.

- Connect Your Bank – Set up bank feeds to import transactions automatically.

- Create Your Chart of Accounts – Customize your financial setup or use templates.

- Start Invoicing – Bill your clients and get paid faster.

- Invite Your Accountant or Bookkeeper – Collaborate directly in the app.

Final Verdict: Is Xero Worth It?

Absolutely — Xero is a top-tier accounting solution for businesses that want robust features, great usability, and strong automation in a cloud-based package. It’s an excellent choice for those who don’t want to overcomplicate their accounting, yet need powerful tools for reporting, invoicing, and inventory.