Table of Contents

Introduction

Accounting software is the backbone of modern businesses. From managing invoices to reconciling bank statements and generating financial reports, the right tool can save hours of work while providing valuable insights into your business performance.

In 2025, business owners face an overwhelming array of accounting solutions. Among the leading players are Xero, QuickBooks, Sage, and Microsoft Dynamics 365 Business Central. Each platform offers strong features, but the choice depends heavily on your business size, budget, and future growth plans.

1. Company Overview

Xero

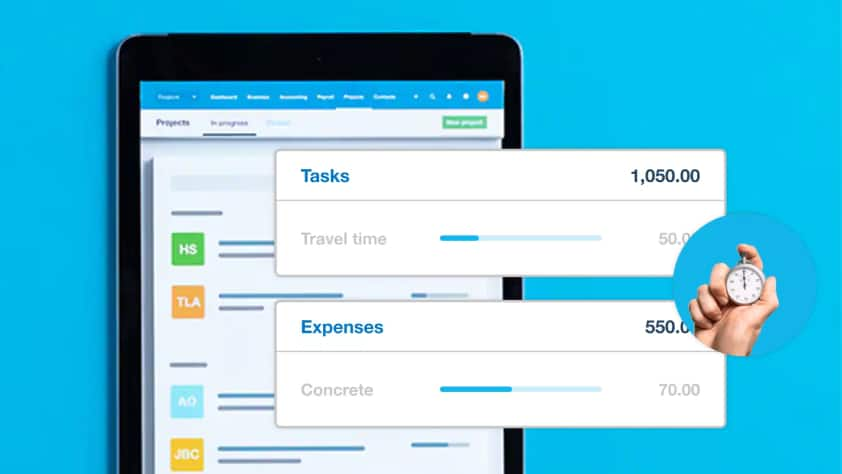

Founded in 2006 in New Zealand, Xero quickly grew into a global force with over 3.95 million subscribers. Xero is entirely cloud-based and designed with simplicity in mind, making it a favorite among startups and small businesses. In 2025, Xero continues to grow profitably, expanding features through acquisitions like Melio (for payments) while focusing on ease of use.

QuickBooks (Intuit)

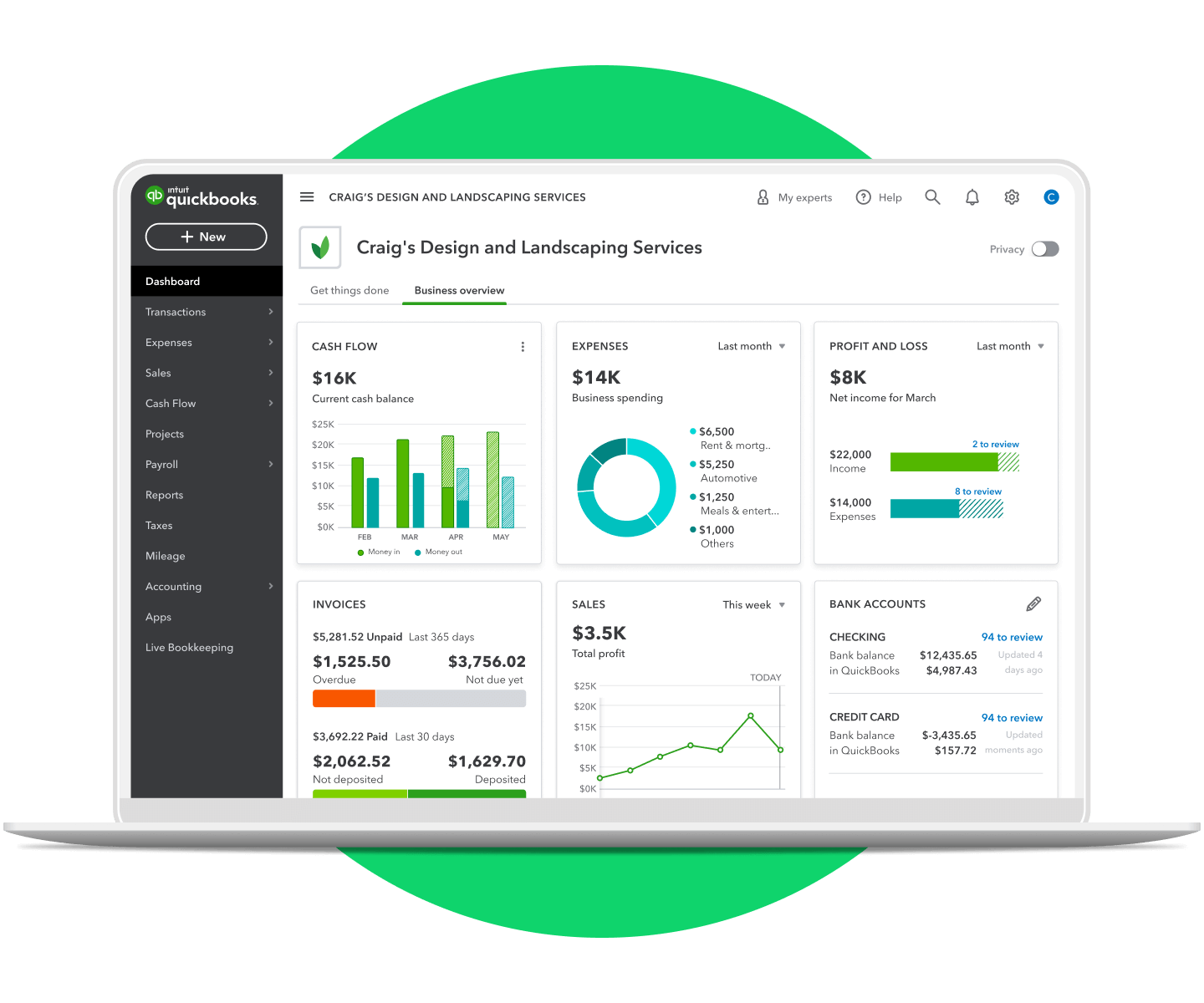

Launched in 1992 by Intuit, QuickBooks is arguably the most recognized accounting brand. Its U.S. dominance is unmatched, and it provides localized versions across multiple countries. QuickBooks Online offers strong features like payroll, tax compliance, and inventory. However, some users report a steeper learning curve.

Sage

Sage Group, founded in 1981, is a UK-based software giant with decades of accounting expertise. Its offerings cover both SMEs and larger organizations. Sage is particularly strong in reporting, payroll, and compliance in the European market, though its interface feels more “traditional” compared to cloud-native Xero.

Microsoft Dynamics 365 Business Central

Unlike the others, Business Central is more than just accounting—it’s an ERP (Enterprise Resource Planning) platform. Backed by Microsoft, it integrates with the entire Microsoft ecosystem, making it a strong choice for mid-market businesses seeking scalability. However, it comes with ERP-level complexity and pricing.

2. Pricing Comparison

Pricing is always a critical factor for small businesses. Let’s break down how Xero compares.

Xero Pricing (2025, U.S. plans)

- Early Plan: $20/month – for freelancers & startups

- Growing Plan: $47/month – for growing small businesses

- Established Plan: $80/month – full-featured, including multi-currency and expenses

👉 Special Offer: Get 50% off for 3 months.

QuickBooks Online Pricing (2025)

- Simple Start: $30/month

- Essentials: $60/month

- Plus: $90/month

- Advanced: $200/month

Sage Business Cloud Accounting

- Start: $10/month (basic invoicing, entry-level)

- Accounting: $25/month (full bookkeeping features)

- Advanced: ~$70/month (with payroll & extras)

Microsoft Business Central

- Essentials: ~$70/user/month

- Premium: ~$100/user/month

- Advanced ERP packages: $130+/user/month

Verdict on Pricing

- Most affordable: Xero, especially with its unlimited users policy.

- Most expensive: Microsoft Business Central, reflecting its ERP functionality.

- Middle ground: QuickBooks and Sage, though QuickBooks pricing escalates quickly as businesses scale.

3. Ease of Use & User Experience

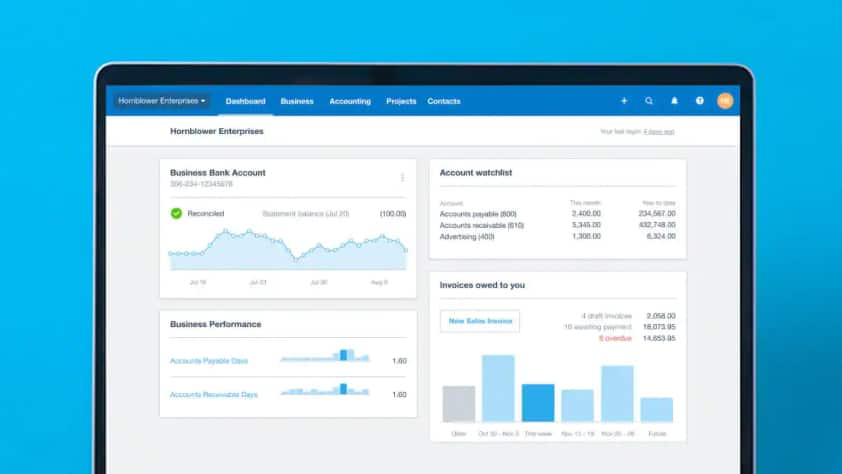

- Xero: Clean interface, minimal learning curve, and a powerful mobile app. Small businesses praise its simplicity. Even non-accountants find it easy to get started.

- QuickBooks: Feature-rich but can overwhelm beginners. The dashboard is not as intuitive as Xero’s, though seasoned accountants often prefer it.

- Sage: Offers solid functionality but the interface feels less modern. It’s more suited for accountants than non-finance professionals.

- Business Central: Complex ERP-like interface. Great for finance teams in medium-sized enterprises, but overkill for small businesses.

👉 If ease of use is your top priority, Xero wins hands down.

4. Features Breakdown

4.1 Invoicing & Payments

- Xero: Customizable invoices, recurring billing, automatic payment reminders, and integrations with Stripe, PayPal, Square.

- QuickBooks: Similar invoicing features with deeper tax integration.

- Sage: Strong invoicing and cash flow forecasting but less customizable.

- Business Central: Powerful but requires setup expertise.

4.2 Bank Reconciliation

- Xero: Real-time bank feeds and smart reconciliation suggestions—one of its strongest selling points.

- QuickBooks: Strong reconciliation but sometimes manual adjustments are needed.

- Sage: Works well but not as seamless as Xero.

- Business Central: Enterprise-level reconciliation, complex setup.

4.3 Reporting & Analytics

- Xero: Simplified reports, real-time dashboards, multi-currency support.

- QuickBooks: Advanced reporting and tax prep tools, but higher-tier plans required.

- Sage: Extremely detailed reporting, great for accountants.

- Business Central: Enterprise-grade reporting with integration to Power BI.

4.4 Payroll

- Xero: Payroll add-ons available in certain regions.

- QuickBooks: Integrated payroll in the U.S.—a major strength.

- Sage: Payroll is one of Sage’s core strengths.

- Business Central: Advanced payroll as part of ERP modules.

4.5 Inventory

- Xero: Basic inventory built-in; advanced management requires integrations like Unleashed.

- QuickBooks: Built-in inventory with multi-location support.

- Sage: Offers comprehensive inventory with higher plans.

- Business Central: Robust supply chain & inventory management at ERP scale.

5. Integrations & Ecosystem

- Xero: 1,000+ integrations (Shopify, HubSpot, Stripe, Gusto, Zapier, etc.).

- QuickBooks: 650+ integrations, strong U.S. payroll ecosystem.

- Sage: Limited ecosystem compared to Xero and QuickBooks.

- Business Central: Deep Microsoft integrations (Teams, Power BI, Outlook, Dynamics).

👉 For flexibility and app add-ons, Xero is unmatched.

6. Scalability & Use Cases

- Xero: Startups, freelancers, small businesses, and SMEs scaling globally. Unlimited users make collaboration effortless.

- QuickBooks: Best for small to mid-sized businesses with U.S. operations requiring tax integration.

- Sage: Great for UK and EU businesses focused on compliance and payroll.

- Business Central: Best for companies moving from SME to mid-market needing full ERP.

7. Market Presence & Growth

- Xero: 3.95M+ subscribers, strong growth in Australia, UK, and North America.

- QuickBooks: Dominates the U.S. market.

- Sage: Significant share in UK & Europe.

- Business Central: Gaining traction with Microsoft users upgrading from basic accounting.

8. Pros & Cons

| Software | Pros | Cons |

|---|---|---|

| Xero | User-friendly interface Unlimited users on all plans 1,000+ third-party integrations Affordable pricing + 50% off for 3 months link . Excellent mobile app & bank reconciliation. | Basic inventory (advanced requires add-ons) Payroll limited to select regions |

| QuickBooks | Strong U.S. tax compliance Integrated payroll in the U.S. Built-in inventory & multi-location tracking . Advanced reporting & analytics | Higher cost per user Steeper learning curve for beginners Some features locked behind premium plans |

| Sage | Excellent reporting and forecasting Strong payroll tools Affordable entry-level plan Well-suited for UK/EU businesses | Outdated interface Limited app ecosystem Not as intuitive for non-accountants |

| Microsoft Business Central | Full ERP functionality Deep Microsoft integrations (Power BI, Outlook, Teams) Advanced inventory & supply chain features Highly scalable for mid-market businesses | Expensive per-user pricing Complex setup & onboarding Overkill for small businesses |

9. Why Xero Wins in 2025

Xero’s ease of use, pricing, and scalability make it a standout choice for small to medium-sized businesses. Unlike QuickBooks, it doesn’t charge per user. Unlike Sage, it feels modern and intuitive. Unlike Business Central, it doesn’t overwhelm small businesses with ERP complexity.

Add to that the special 50% off for 3 months deal, and Xero is a no-brainer for business owners looking for powerful accounting software that won’t break the bank.

Sign up for Xero today and experience accounting the way it should be—simple, scalable, and smart.

10. Final Verdict

- Choose Xero if you’re a startup, freelancer, or small business wanting affordability, unlimited users, and seamless integrations.

- Choose QuickBooks if advanced reporting and U.S. tax/payroll compliance are your priorities.

- Choose Sage if you’re in the UK/EU with heavy payroll needs.

- Choose Business Central if you’re scaling into a mid-sized enterprise and need ERP-level functionality.

For the majority of small businesses in 2025, Xero is the best balance of power, price, and usability.

👉 Don’t wait—start your journey with Xero today and grab 50% off for the first 3 months here: Try Xero Now.