Table of Contents

Running a small business can feel like a juggling act. Between managing client relationships, keeping track of inventory, and driving growth, one area often causes unnecessary headaches—business payments.

Paper checks, manual data entry, late fees, mismatched invoices, and clunky bank portals all add up to wasted hours and unnecessary costs. This is where Melio steps in.

Melio is not just another payment tool—it’s a complete accounts payable and receivable platform built with ease of doing business in mind. It empowers small business owners, accountants, and bookkeepers to pay and get paid seamlessly, securely, and on time.

In this blog post, we’ll break down what makes Melio a game-changer, how its features simplify workflows, and why it could be the best solution for your financial operations. Stick around until the end for a step-by-step guide on getting started with Melio and an exclusive link to sign up.

👉 Click here to try Melio today

What is Melio?

Melio is a B2B payments platform designed to simplify how businesses pay vendors, manage invoices, and collect payments. Whether you’re a small business owner managing cash flow or an accountant juggling multiple clients, Melio removes the friction of traditional payment systems.

At its core, Melio enables you to:

- Pay vendors via bank transfer, credit card, or check

- Send and track invoices digitally

- Automate recurring bills and batch payments

- Sync with accounting software like QuickBooks and Xero

- Handle domestic and international payments

What makes Melio stand out is its flexibility and simplicity—features traditionally locked behind enterprise-level solutions are now available to SMBs, with transparent pricing and intuitive workflows.

Key Features That Make Work Easier with Melio

Melio has packed its platform with features that not only save time but also give you better control over your financial operations. Let’s break them down.

1. Flexible Payment Options

One of the biggest advantages of Melio is the variety of payment methods it supports:

- ACH bank transfers (free for U.S. domestic payments)

- Credit card payments (2.9% fee, but helps extend float or earn rewards)

- International transfers to over 80 countries

- Mailed paper checks for vendors who prefer traditional methods

This flexibility means you can pay vendors in the way that best suits your cash flow strategy—whether that’s maximizing card points or keeping things fee-free via bank transfers.

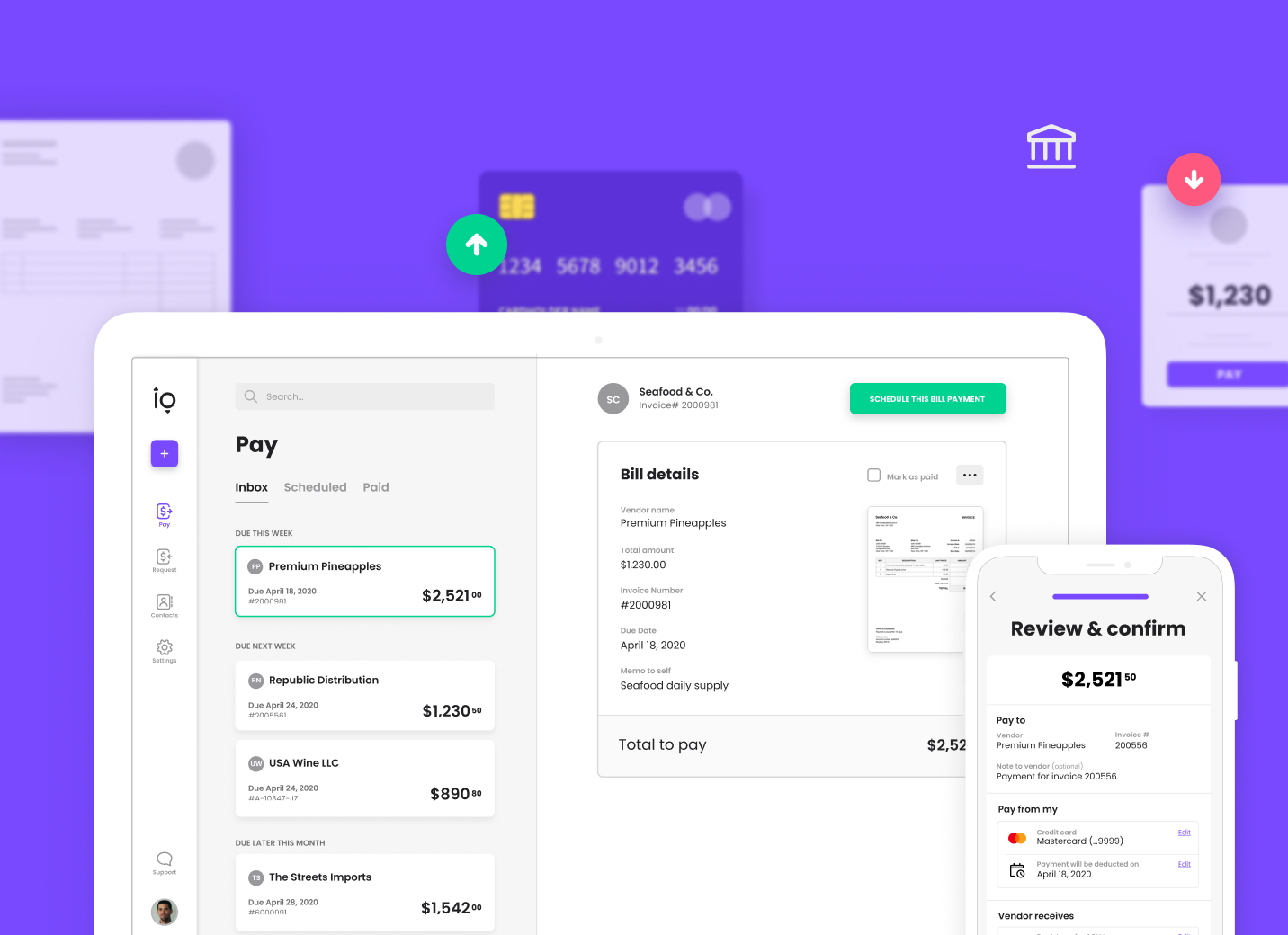

2. One Dashboard for All Payments

No more bouncing between spreadsheets, emails, and banking portals. Melio consolidates accounts payable and accounts receivable into one intuitive dashboard.

You can:

- View upcoming bills at a glance

- Track vendor payments and client invoices

- See cash flow insights in real time

This holistic view makes financial management less overwhelming, particularly for business owners wearing multiple hats.

3. Batch and Recurring Payments

Time is money—and Melio helps you save both with automation features:

- Batch payments: Pay multiple vendors in a single click.

- Recurring payments: Set up schedules for utilities, rent, or subscriptions.

- Payment reminders: Never miss due dates, avoiding costly late fees.

For accountants managing multiple client accounts, this is a game-changer—imagine cutting down hours of repetitive bill-paying into just minutes.

4. Smart Invoice Management

Invoices don’t have to be a headache. Melio allows you to:

- Upload invoices by scanning, emailing, or importing them directly

- Auto-extract vendor and payment details

- Track status (paid, pending, overdue) in real time

This reduces manual data entry, minimizes errors, and keeps your financial records clean and organized.

5. Seamless Accounting Integrations

Melio integrates directly with QuickBooks Online, Xero, and Amazon Business, meaning your payment data automatically syncs with your books.

Benefits include:

- No manual reconciliation

- Accurate real-time financials

- Faster closing of monthly/quarterly accounts

This is particularly valuable for accountants and bookkeepers—less admin, more advisory work.

6. Team Collaboration & Approval Workflows

For businesses with multiple stakeholders, Melio offers customizable approval workflows.

- Assign roles (owner, accountant, manager, etc.)

- Define approval chains for different payment amounts

- Track activity logs for accountability

This ensures financial control without bottlenecking operations.

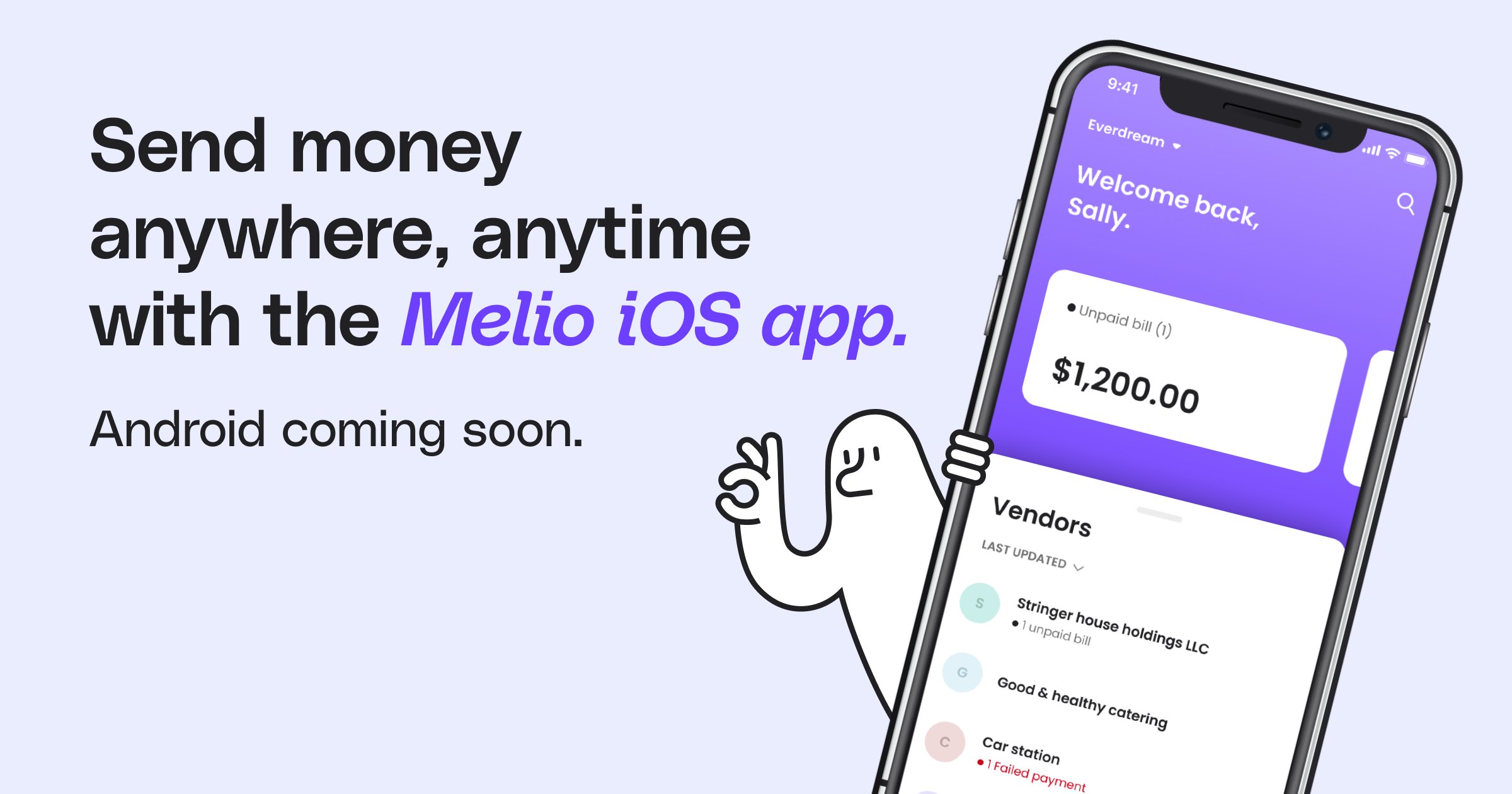

7. Mobile-First Experience

Melio’s mobile app allows you to:

- Approve or schedule payments on the go

- Snap photos of invoices

- Securely log in with Face ID or fingerprint

Business doesn’t stop when you’re away from your desk—and neither should your payment processes.

8. Security and Compliance

Melio employs industry-grade encryption, fraud monitoring, and compliance standards. Users can trust that every transaction is safe, transparent, and traceable.

This isn’t just peace of mind—it’s business-critical security.

Why Melio Makes Business Work Easier

The features are impressive, but the real value lies in how they translate to easier daily work:

- Save time with automation and batch processing

- Improve cash flow by leveraging credit cards for vendor payments

- Eliminate errors with invoice scanning and accounting integrations

- Increase transparency with real-time dashboards and workflows

- Work flexibly from desktop or mobile

In short: Melio helps you do more in less time, without sacrificing control or accuracy.

Melio vs. Traditional Payment Methods

| Feature | Traditional Bank Transfers | Paper Checks | Melio |

|---|---|---|---|

| Cost | Often fees apply | Postage costs | Free ACH, low card fee |

| Speed | 2-5 days | 5-7 days | Same/next day options |

| Flexibility | Limited | None | Card, ACH, Check, Intl |

| Automation | Rare | None | Recurring + batch |

| Integrations | None | None | QuickBooks, Xero |

| Ease of Use | Low | Low | High |

Clearly, Melio offers significant advantages over old-school systems.

Who Benefits Most from Melio?

- Small Business Owners

Spend less time on admin, more on growth. - Accountants & Bookkeepers

Manage multiple clients with ease, streamline AP/AR, and reduce manual entry. - Freelancers & Solopreneurs

Look more professional with seamless invoicing and payment options. - Remote Teams

Collaborate securely, even across geographies.

Real-Life Testimonials

- “Melio helps my company be more successful. Plain and simple. It’s been a money saver and a time saver.” – Michael T. Thaxton, Thaxton & Associates

- “Managing multiple clients’ accounts payable is no longer a chore. Thank you Melio.” – Joanne Ort, CPA

These stories highlight how Melio transforms payment management into a growth enabler.

Step-by-Step: How to Get Started with Melio

- Sign up for free. : Click here to create your account

- Connect your bank account or credit card

- Import invoices (scan, email, or upload)

- Set up vendors and clients

- Schedule payments or create recurring bills

- Sync with QuickBooks/Xero to keep everything aligned

- Track progress via the dashboard or mobile app

In less than 30 minutes, you can be fully set up and running.

Pros and Cons of Melio

Pros:

- Free ACH transfers

- Wide range of payment methods

- Excellent accounting integrations

- Mobile-first and easy to use

- Batch/recurring payments save huge time

Cons:

- 2.9% fee on credit card payments

- Limited international currency options (USD only)

- Works best for U.S.-based businesses

Final Verdict: Should You Use Melio?

If you’re a small business, accountant, or freelancer looking to simplify payment workflows, Melio is one of the best tools available today.

Its combination of ease of use, powerful automation, and financial flexibility makes it an indispensable ally for modern businesses.

By adopting Melio, you’re not just paying bills—you’re unlocking time, control, and peace of mind.

👉 Ready to make business payments effortless?

Start your journey today with Melio: https://affiliates.meliopayments.com/3u8xpeiuv2ye