Overview

Melio Payments is a leading platform designed to simplify invoice payments and enhance cash flow management for businesses. It provides businesses with the control to handle payments according to their schedules and preferences rather than conforming to the terms set by vendors, suppliers, or contractors. This review covers the essential features, benefits, drawbacks, and overall performance of Melio Payments.

Table of Contents

Key Features

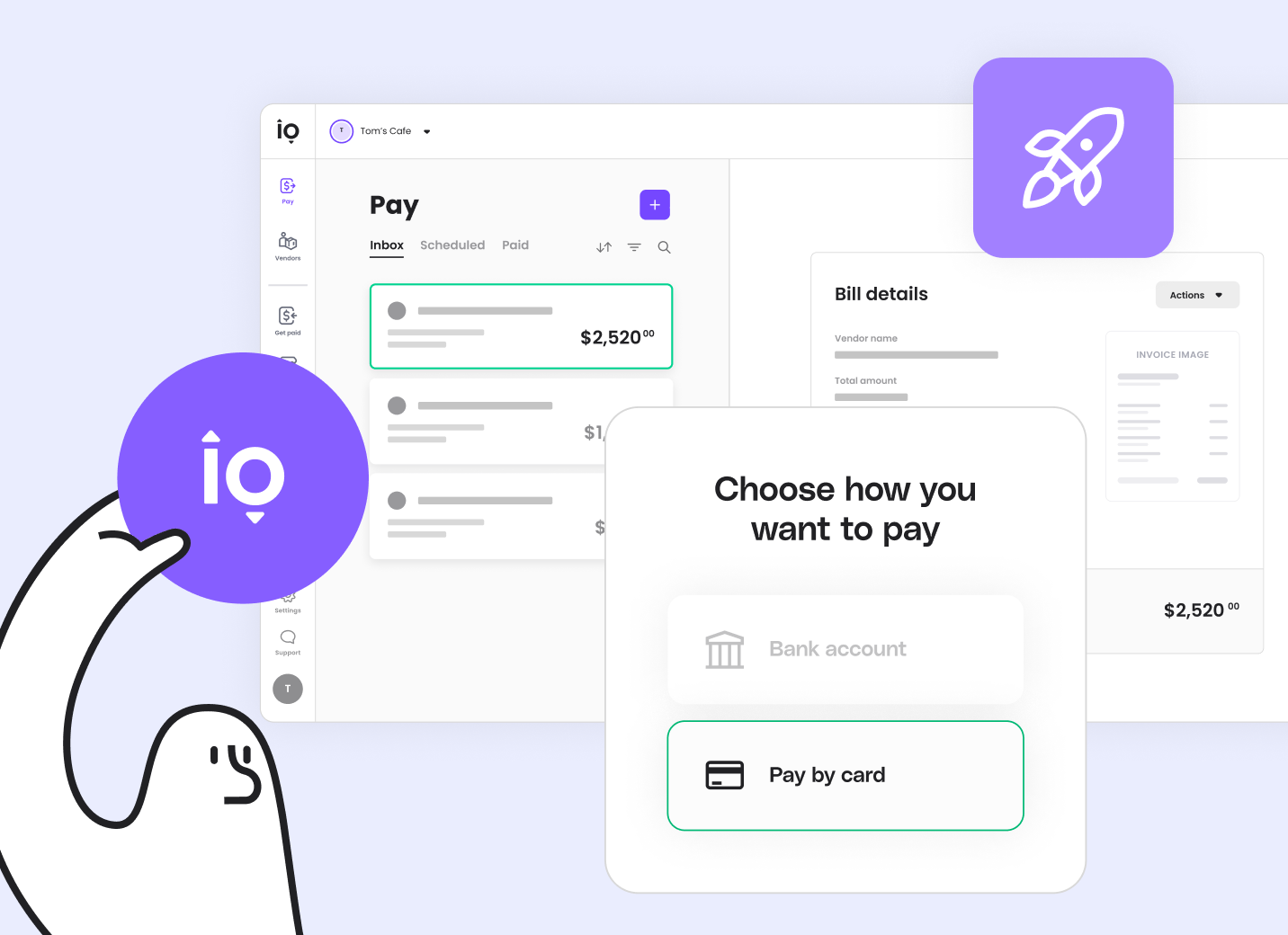

1. Centralized Payments Dashboard

Melio offers a centralized dashboard that enables businesses to manage all their payments in one place. This feature ensures streamlined operations and better oversight of outgoing payments.

2. Payment Flexibility

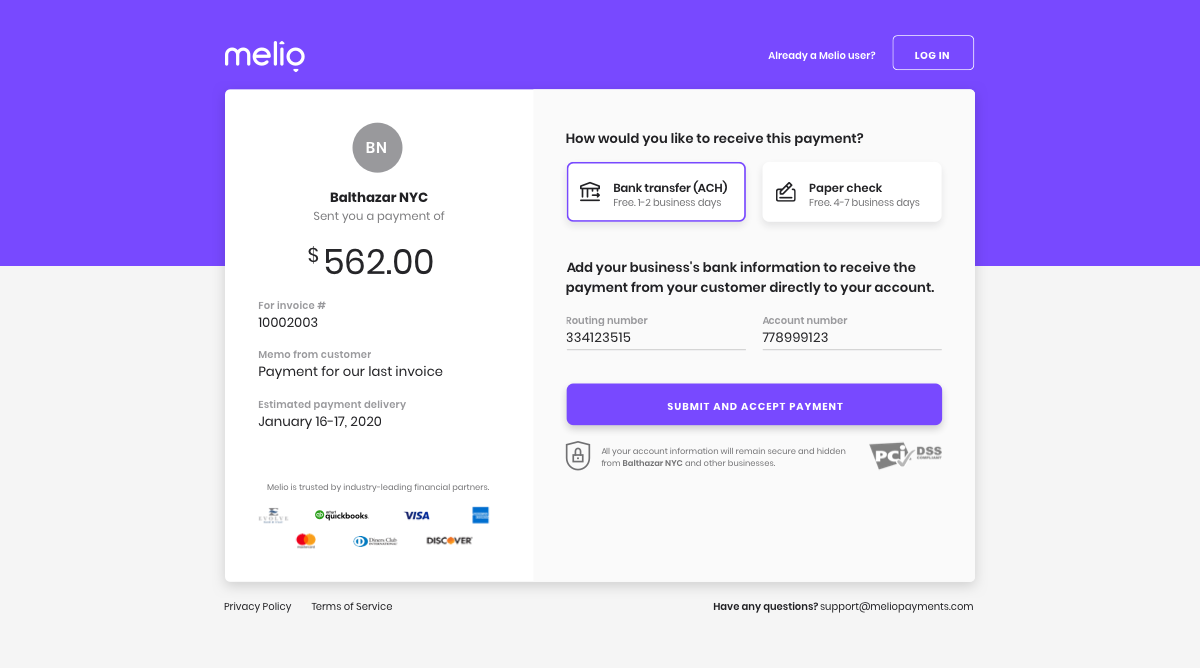

Vendors can receive payments via bank transfer or check without needing a Melio account. This flexibility makes it easier for businesses to work with various partners without worrying about compatibility issues.

3. Accounting Software Integration

Melio integrates seamlessly with popular accounting software such as QuickBooks, Xero, and FreshBooks. This integration allows for easy synchronization of financial data, reducing manual entry errors and saving time.

4. Batch and Split Payments

Businesses can combine or split payments to vendors, which helps in managing cash flow more efficiently. This feature is particularly useful for businesses dealing with multiple invoices or payments at once.

5. Approval Workflows

Melio enables businesses to set up approval workflows, ensuring that payments are authorized by the appropriate team members. This adds an extra layer of security and control over financial transactions.

6. Mobile Accessibility

With a newly launched iOS app, Melio allows users to manage payments on the go. The responsive web interface ensures that Android users can also access the platform seamlessly through their browsers.

Benefits

1. Ease of Use

Melio Payments is known for its simple and intuitive interface, making it easy for users to navigate and perform transactions. The user-friendly design ensures that businesses can quickly adopt and utilize the platform without extensive training.

2. Cost-Effective

There are no monthly fees and no charges for ACH bank transfers, making Melio a cost-effective solution for businesses looking to manage payments without incurring additional costs.

3. Flexible Payment Options

Melio allows businesses to pay invoices via credit card, even if the vendor doesn’t accept cards. This feature comes with a 2.9% fee but provides flexibility in managing payments and improving cash flow.

4. Attractive Sign-Up Offer

New users are eligible for a $100 sign-up bonus upon making their first payment of $200 or more through Melio. This incentive encourages businesses to try out the platform.

Drawbacks

1. Customer Support

One area where Melio could improve is customer support. Currently, there is no phone support available, although live chat and email support options are provided. Some users may prefer direct phone assistance for resolving issues quickly.

Pricing Structure

- Free ACH Transfers: ACH to ACH bank transfers are free, making it cost-effective for routine payments.

- Card Payments: There is a 2.9% fee for credit/debit card payments, which is competitive within the industry.

- Additional Fees: Same-day transfers incur a 1% fee, and international USD transfers have a flat fee of $20.

Use Cases

1. B2B Payments

Melio is ideal for businesses that need to pay for goods, services, rent, utilities, SaaS tools, and inventory. It simplifies the payment process and ensures timely transactions.

2. Popular Among

The platform is particularly popular among small businesses, accountants, and firms managing multiple clients. Its ease of use and integration capabilities make it a valuable tool for these groups.

Competitors

Melio faces competition from several other platforms, including Bill.com, Airbase, PayPal, and Stripe. Each of these competitors offers unique features and pricing structures, making it essential for businesses to compare options based on their specific needs.

Security

Melio places a high emphasis on security, backed by over $500 million in funding. This investment ensures that the platform utilizes top-tier security measures to protect user data and transactions.

Final Verdict

Melio Payments stands out as a robust tool for businesses looking to streamline their B2B payment processes. Its ease of use, cost-effectiveness, and flexible payment options make it a preferred choice for many businesses. Although the lack of phone support is a minor drawback, the overall benefits and competitive pricing make Melio a top contender in the payment solutions market.

Rating: 4.5/5 stars, with ongoing positive feedback from users on G2.com .

Note

Always ensure secure passwords and be cautious of phishing scams. Conduct thorough research before making financial decisions to ensure the chosen platform meets your business needs.

Stay tuned to BlogYouNeed for more in-depth reviews and insights into the best products and services available to help you make informed decisions!